If you have been watching the news, you may have now…

Are You a Professional Investor? LOL

Are you a professional investor? No? So why are you investing your savings?

A professional investor is one of those crazy day traders with five computer monitors in their attic. Someone who reads company annual reports and balance sheets. Someone who studies crop reports and technical trading. A Wall Street Journal subscriber.

Is that you?

Remember: Investment is the possibility of gain to the possibility of total loss. Savings, at the very least, means not losing what you have. Some reasonable growth, without the possibility of loss, was in the past what most people expected.

Investment is done with money you can afford to lose. Stock and bonds are gambles, with less certain odds than on a Vegas crap table. Or, for the entrepreneurial types, a risk you understand to the best of your ability and willingly take, with the real possibility of you eating ramen noodles for a long time if things don’t work out.

Yet, since the 1970’s, our savings have been forced into investments. Your “savings” plan at work, e.g., 401(k), IRA, is a gamble in not one but TWO ways:

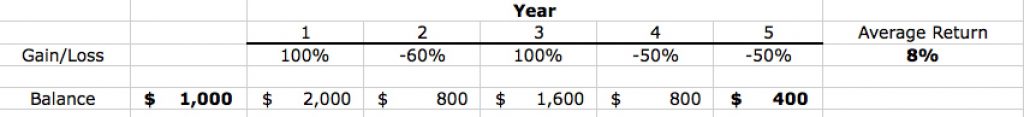

First. Your savings are invested in the Wall Street world of stocks and bonds and mutual funds. No guarantees. You may read the pretty brochures that talk about the past, and at the same time say that past has no relation to future returns. Very true. But even the “average” returns shown for this fund or that fund, these averages, while mathematically true, do not betray the hidden monster of volatility. A loss in any year will drastically reduce the return, and lots of up and down (volatility) can mean that even with an “8%” average return, you can end up with zero net profit, or a loss (take a look at the figure for an example). But you let Wall Street use your money, so that’s good for them.

Second: Taxes. What many do not understand is that by “deferring” taxes in a payroll savings plan, you delay the tax and the calculation. That is, you do not know what your tax rate in the future will be. Don’t assume it will be less. Also, if your plan does accrue gains, you pay more total tax when you need the money the most. Some ask the question, “would you rather pay tax on the seed or the crop?” More on this in another post to come.

Your savings need to be held at the lowest possible risk. Right now, the roulette wheel is spinning.

There is a way out.

That is personal banking.

This Post Has 0 Comments